Downloadable PDF Form 1040 (Schedule C) 2024-2025

Show details

Hide details

R line 13 to find out if you must file Form 4562. / When did you place your vehicle in service for business purposes month day year Of the total number of miles you drove your vehicle during 2018 enter the number of miles you used your vehicle for b Commuting see instructions Business c Other Was your vehicle available for personal use during off-duty hours Do you or your spouse have another vehicle available for personal use. Go Department of the Treasury Internal Revenue Service 99 ...

4.5 satisfied · 46 votes

form-1040-schedule-c.com is not affiliated with IRS

Filling out Form 1040 (Schedule C) online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A complete guide on how to Form 1040 (Schedule C)

Every person must declare their finances in a timely manner during tax season, providing information the Internal Revenue Service requires as precisely as possible. If you need to Form 1040 (Schedule C), our secure and intuitive service is here to help.

Make the following steps to Form 1040 (Schedule C) quickly and precisely:

- 01Import our up-to-date form to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Go through the IRSs official instructions (if available) for your form fill-out and accurately provide all information requested in their appropriate fields.

- 03Fill out your document using the Text option and our editors navigation to be confident youve filled in all the blanks.

- 04Mark the boxes in dropdowns with the Check, Cross, or Circle tools from the tool pane above.

- 05Take advantage of the Highlight option to stress particular details and Erase if something is not relevant anymore.

- 06Click the page arrangements button on the left to rotate or remove unnecessary document sheets.

- 07Check your forms content with the appropriate personal and financial paperwork to ensure youve provided all details correctly.

- 08Click on the Sign tool and create your legally-binding electronic signature by uploading its image, drawing it, or typing your full name, then place the current date in its field, and click Done.

- 09Click Submit to IRS to e-file your tax statement from our editor or choose Mail by USPS to request postal document delivery.

Choose the best way to Form 1040 (Schedule C) and report on your taxes online. Give it a try now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

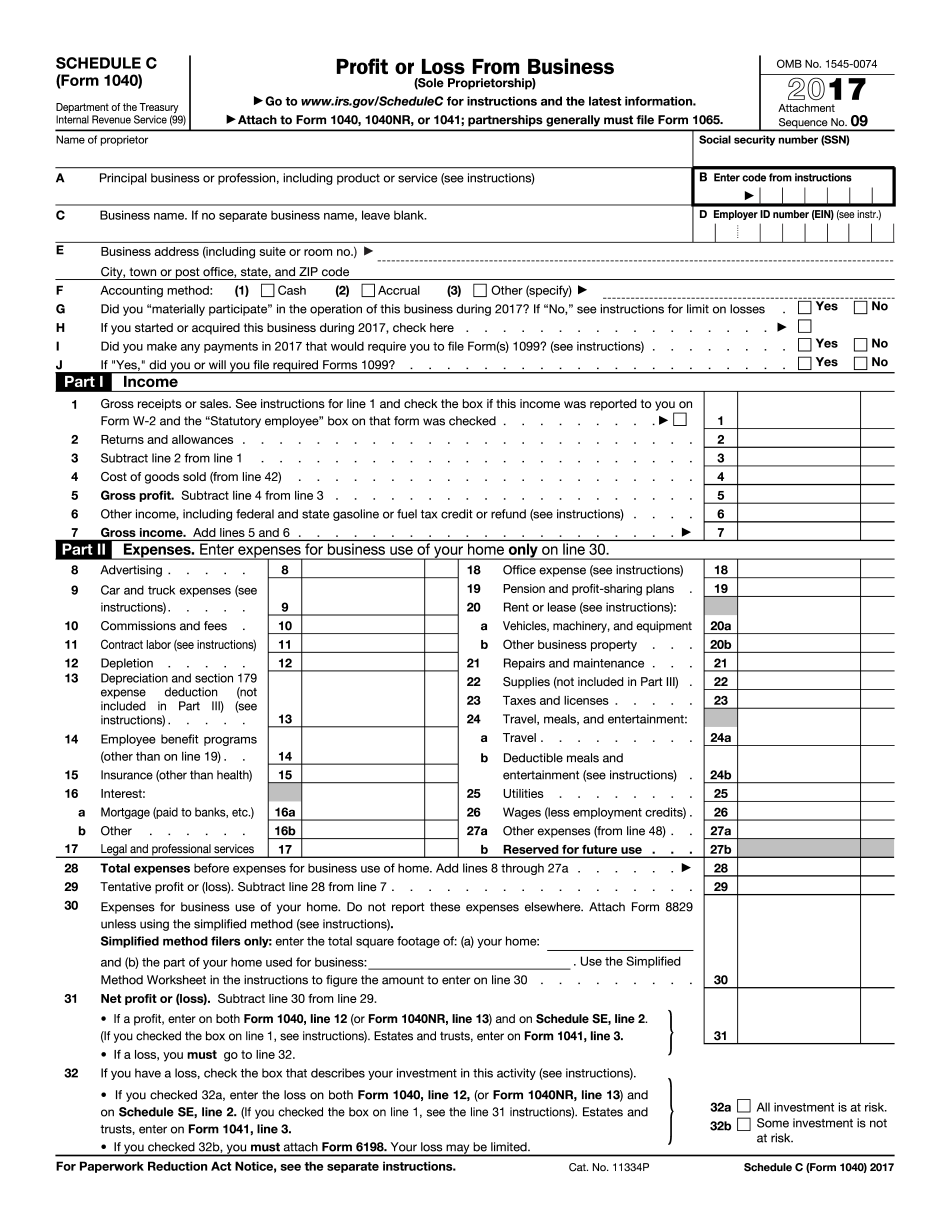

What Is Schedule C?

Sole proprietors have to prepare Schedule C to report the income for the tax year and deductible expenses. This document also known as Profit or Loss from Business is important for owners of a small business and for sole proprietors of a limited liability company.

It is required to pra separate sample for each organization you own.

Schedule C has to be attached to the 1040 Form and forwarded to the Internal Revenue Service.

You may find the appropriate template on the internet and complete it online. Enter the necessary information into fillable fields, add your signature and share the file via email, fax or sms.

Search for the appropriate fillable blank. Open it from any internet connected device. Read the instructions below in order to complete the template correctly.

- 01Indicate an income statement for the tax year.

- 02Pra balance sheet for the same period.

- 03List statements pertaining to the purchase of the assets for the tax year (vehicles, equipment, land and buildings).

- 04In case your firm sells products, include details about inventory to prepare a cost of goods sold calculation.

- 05Enter data regarding the transportation, meals and entertainment. Specify home business expenses.

Download the document to your device and forward it to the Internal Revenue Service. If necessary, print out the blank and fill it out by hand.

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form 1040 (Schedule C)?

Form 1040 (Schedule C) is the official form for taxpayers who are required to file the Form 1040 (Schedule C).

It contains all the information you will need to properly file your tax return. The amount of tax due will be listed on the front page with Form 1040 (Schedule C) in the upper right-hand corner of the return. Your IRS tax return will be sent to you in due order, along with a notice that you have been issued a tax notice.

For more information on Form 1040 (Schedule C), see IRS.gov/Form1040CTRL. For more information on the return type required, see Form 1040 (Schedule C).

For more information on whether you need to complete Schedule C or Form 1040 (Schedule C), see Do you need to complete a Schedule C or Form 1040 (Schedule C)?

Schedule C Form 1040 (Schedule C) is made for taxpayers who: Have a net operating loss carry-forward and a net operating loss carry-forward of qualifying losses; and Do not take a loss on an operation that is a qualified investment.

You may not have to submit Schedule C if you filed a return for the year with a net operating loss carry-forward of 3,000 or more.

However, you will have to submit Schedule C for any net operating loss that you or anyone else had during the 10-year period before this year.

For example, if you and a co-worker acquired a qualifying business in the same year, but there was never an operation in the first year that was a qualified investment, you may have a net operating loss carry-forward to use for the following year.

The first-year qualified investment is defined in section 1382.

If you are not sure whether you must use Schedule C, ask your IRS preparer or accountant for the appropriate form.

If you will be filing Form 1040 (Schedule C) electronically, prepare and submit it electronically with a separate Schedule C for each year that you may be subject to the alternative minimum tax.

You have to give your employees Form 1040 (Schedule C), Form 1040 A (for self-employed individuals), Form 1040 Schedule H and Form 1040 ASE (for self-employed taxpayers under 49 USC 5101), if your business income is to be reported on those forms.

Who should complete Form 1040 (Schedule C)?

If you're an employee, you should complete Form 1040 (Schedule C) if you're paid for your services and expect to receive more than 600 in gross income in a year. If you're self-employed, you should complete Form 1040 (Schedule K–1) if you're paid for your services and expect to receive more than 600 in gross income in a year. The number on your Form 1040 is the net payment amount for your services in accordance with the table below, and must be reported on Form 1040 (Schedule C) or Form 1040NR (Schedule K–1). If you're an employee, the number on your return is the amount that you would have withheld for self-employment tax for the year. If you're self-employed, the amount withheld is reduced by the amount of any tax-exempt interest, dividends, and capital gain realized by you. Your return is due April 15 of the following year. If you paid a Form 1099-INT to get the information, report the payment in box 8 of Schedule D.

Your Adjusted Gross Income (AGI) doesn't include all your income. If it does, include any of your income on Form 1040 or Form 1040NR (depending on whether the income is taxable or exempt income) (or if you use the Schedule K–1 to report exempt income, as described below). Include any self-employment tax on Schedule A (Form 1040) or Schedule A (Form 1040NR) and any business loss on Schedule D (Form 1040).

How can you tell if you earned business income?

The IRS is requiring you to report gross income (which includes interest, dividends, and capital gains) over 600 for all self-employed income. This applies whether you're required by law to report it. You don't need to withhold it. You just need to include it on your tax return.

If your employer withholds taxes that you paid, your withholding will be reported in box 8 of your Schedule A (Form 1040) or Schedule A (Form 1040NR) and your federal tax return will still include it as business income from self-employment.

If you were paid a Form W-2G, you may receive a Form W-9, which will report any self-employment tax withheld from wages from your employer.

When do I need to complete Form 1040 (Schedule C)?

The due dates listed in each form are the due dates that apply for individual income tax purposes. The due dates can change occasionally if additional information is required.

For more information on the tax consequences to you in the event that you claim a standard deduction in an earlier year, see Standard Deduction in earlier years.

If you are an employee and you elect to have Form 1040X, U.S. Foreign Earned Income Tax Return, or Form 1040NR, U.S. Foreign Income Tax Return, electronically filed with your income tax return, you must enter the information electronically or have a written acknowledgment of the statement of information and attachments provided (generally Form W-4, Wage and Tax Statement, or an equivalent document) to the IRS in order to be filed electronically.

For more detailed information about how the IRS uses Form 1040-ES, U.S. Foreign Earned Income Tax Return, to determine income tax filing requirements, refer to the Instructions for Form 1040-ES, U.S. Foreign Earned Income Tax Return or Form 1040-NR, U.S. Foreign Income Tax Return.

For further guidance, refer to the section called Income Tax Computations — Individuals.

Back to top

What do I need to do before sending an extension request?

You can extend any tax filing deadline you have previously requested at . Before sending an extension request, verify whether an extension is appropriate. To ensure a timely tax return, you should make every reasonable effort to file your return by the due date. Late filing penalties may apply if you file too late.

If you have no reason to believe that filing a timely tax return would endanger your ability to obtain future benefits, you should ask the IRS to extend the filing deadline instead.

See a sample letter: Request of extension for filing a U.S. tax return.

Can I create my own Form 1040 (Schedule C)?

A. In general, no. The IRS is required to take a Schedule C and make it available to the public. Any tax form that is not available for public use or may contain sensitive information, also should not be made available through any third party.

Q. What do the terms “Schedule C,” “Schedule SE” and “Schedule TR” mean?

A. When you get a Form 1040-MISC (for an individual) or a Form 1040-ES (for a corporate entity) you must fill it out on these schedules. “Schedule SE” is usually used when you are filing a joint return. When you file as an individual with or without your spouse, you either attach Form SE at line 6 or Line 7.

The term “Schedule TR” refers to filing with the IRS forms to report information about the gross estate:

(1) A trust estate for which the surviving spouse is the executor on any trust instrument, or

(2) If the deceased was not a trust holder or beneficiary, a trust for the benefit of certain disabled veterans or dependent students.

Q. Do Form 1040-MISC and Form 1040-ES have special sections for certain types of beneficiaries?

A. Yes. These provisions give certain kinds of beneficiaries special treatment to take advantage of the estate-tax benefits that flow from inheritance or from the death of a beneficiary who lived with a person during the year. These provisions can apply to the following types of beneficiaries:

You get money in an estate, and you want certain beneficiaries to inherit your money. However, you do not want other beneficiaries to have any share of the estate's money.

You get money or property from a trust estate for which a beneficiary would qualify for the special provision for beneficiaries in trust.

You inherit some money from a deceased person. Furthermore, you want the whole estate (not just money) to receive benefits.

A person with a life or long-term health condition lives with you, but at the time of death the person died, you gave the person money to care for a life or long-term health condition. You want the person's whole estate to receive benefits instead of some of it going to the spouse.

If you are not a beneficiary in a trust but live with a spouse who is a beneficiary, you want to know how the spouse can receive inheritance.

Q.

How do I get my Form 1040 (Schedule C)?

To be included in Schedule C of your Form 1040 (return) you must attach to your return a Form 1040X, Miscellaneous Income (Schedule C) or Form 1040NR, Nonprescription Drug Coverage Information.

Form 1040X: Specify the code X1. This code will have information about the type of item, information about the place(s) received, the amount, dates and dollar amounts.

Form 1040NR: Specify the code NR. Use this code to report payments or reimbursements under a private health plan.

You will not be subject to the 2% withholding tax for Form 1040X. However, you must file a copy of both your Form 1040X and your Form 1040NR. You must send copies with each Federal income tax return.

I am a nonresident and must file a return. What are my tax returns filing requirements?

Generally, any alien who meets the requirements of the Code for a resident alien may file personal income tax returns if he/she meets the requirements for being on Form 6166B. If, however, you are a nonresident of the United States and not listed in this section, you can receive Form 2655-EZ.

The following information applies if you cannot file Form 6166B:

A foreign government cannot receive Form 6166B if it has a treaty or agreement with the United States preventing, among other things, the government from imposing taxes on US citizens or resident aliens. It must rely on the provisions of a federal statute for filing Form 6166A or Form 6166B, or on the authority of a state tax department to accept these returns.

You will not be subject to the 2% withholding tax for Form 6166B. However, you must file a copy of both your Form 6166B and your Form 6166A or Form 6166B, or your copies of either Form 6166A or Form 6166B, with your Federal income tax return. You must send copies with each Federal income tax return.

I am a nonresident alien and do not need to file Forms 6166B with my return. What other filing obligations do I have?

In addition to the filing requirements described above under the general heading of Form 1120-EZ, Information Returns Regarding Individual Tax Year 2013, you must file Form 1120-SE, United States Individual Income Tax Return.

What documents do I need to attach to my Form 1040 (Schedule C)?

If you want to get some free tax help, fill out our Free Tax Consultation form. Fill out this form and get our free tax help:

Fill out the Form 1040 Business Income Tax Return form, as well as any attachments such as schedules, schedules A, schedule B, IRS Form 2023 (Form 2043 if your business has qualified), or IRS Form 4684. Send your Form 1040, Schedule C, Forms 1040A, 1040F, and 1040EZ or Forms 1041(a), (b), (c) or (d) by mail.

Send them to The IRS, c/o Publication 501 (PDF) or see our Business Tax Return page. You can also use our Electronic Filing System. (See our Filing Electronic Instructions page for the details and help.)

What other forms do I need once I send in my Form 1040 (Schedule C)?

Fill out the Form W-2G (or Form W-2G-EZ). Send it to the same address used to file your Form 1040, at the same address that shows on the Form 1040.

Filing a Business Income Tax Return with an Employer

Use the same address that the IRS uses to mail Form 1040 (Schedule C) to get your refund if, on January 1, you are paid under an election, and your employer pays you with pre-tax wages of at least your full wages.

Note: If you filed a Schedule C without an election to pay at least your full wages, the form you should submit after filing a Schedule C is Form 1040EZ (or Form 1040NR for self-employed taxpayers).

If you have an election to pay at least your full wages, file one Form 1040 (Schedule C) for each pay period that qualifies (including all prior work weeks), even if the last pay period qualifies for the last-due penalty.

If you file with an employer that only pays with pre-tax wages, and you are paid under an election to pay at least the full wages, you did not have an election to pay at least your full wages; this is not a valid election. You will get a refund for any tax withheld. For details, see the chart that follows:

Line 1 (If you are paid with pre-tax wages): Enter a range of the federal poverty guidelines.

What are the different types of Form 1040 (Schedule C)?

Each form will have to be used in a particular way

All forms must be used for the same amount

All forms must be used for one taxpayer

You will need to use the proper form for the correct amount

You must use the tax software if you have a tax software which handles schedules C, D, E, and F (which is most popular).

Form 1040B

Form 1040B is similar to Form 1040, but it is used for one person. This is where you have to report all income for that one person. This form is only used one time.

Form 1040EZ

The form 1040EZ is used for corporations. A corporation reports all income on this form. They usually add this amount to the individual's Form 1040.

Form 1040A, Form 1040B

Form 1040A, Form 1040B, and Form 1040C are used by partnerships. The only exception is in the case of an individual who is the sole proprietor of a small business. The individual does not file this form. They can use Form 1053 instead.

Form W-2

Form W-2 form is used by employees to report their wages, salaries, tips, and commissions.

For example, suppose that you work for a company, and you know that the CEO puts in thousands of dollars every year for the company to buy them things from stores.

After the employee's wages are reported on their state income tax return, they will need to add the amount on their Form W-2. This money is also included on their state income tax return. Form W-2 does not show the value of the things that the CEO is buying them. The value is called their “non-business income.”

The IRS considers the CEO's income that comes directly from the company to be “business income.” Therefore, the executive must include that income on his/her state income tax return.

Businesses, such as corporations and partnerships, have the option of reporting their income on Form 1040, Form 1040EZ, Form 1040A, or Form 1040B instead. Each of the forms have some similarities, but each report is for one single event or one individual.

How many people fill out Form 1040 (Schedule C) each year?

That's the largest single section of the tax code.

That's why whether to include the self-employed as a dependent or one of the seven income classes is important. But the answer can be confusing and should be approached with a critical eye to the details. What, exactly, does “independent contractor” mean? What are the requirements for a business use? Does one generally have to claim a personal exemption that amounts to tens of thousands of dollars a year, or does everyone claim their own exemption?

What Is a “Business Use”?

According to the IRS, any use of your services as a separate entity, whether on your own time or through a business or other organization:

a. Is not to “sell” your services.

Beware -- the word “selling” can have a very broad definition. In fact, even if you're a business, and you're getting paid 10 hourly to take a person's prescription, you're not “selling” -- you are, in fact, serving them, or “commingling your services.” That's why many small businesses have to deal with the IRS on that one. It doesn't matter if you're simply providing medical advice to a family member -- you have to report what you're actually doing in business, even if you're only getting paid 10 an hour.

The key is to define your service as that which is not used for profit or as any kind of service (including consulting, teaching, babysitting, or caring for the elderly) or as “trade or commerce.”

Business use must also include the rental of facilities. For example, I write books about running a marathon. In my rental business, I charge for my office space.

For these purposes:

a. “Independent Contractor” means you are the sole proprietor. You are not a “partner” in a business, but rather you have your own business.

b. The “Business Use” of Your Services is Your “PERSONAL USE”

For personal use, use means you actually use the services you are paid for in a way that neither interferes with nor diminishes the value of the business you operate.

This means that, for example, if a medical professional is required to get an exam and fill out paperwork for you, that's not considered to be personal use of the services of the doctor to which you are referring.

Is there a due date for Form 1040 (Schedule C)?

A. Form 1040 should be filed on or before December 31st.

b. The due date is extended to February 15th for federal returns.

c. The due date is extended to March 15th for state, local, and institutional returns.

d. No extensions are required if the returns are filed on or before March 15.

11. What are the filing requirements for Schedule C?

A. Schedule C requires the following documents, listed in the order of priority:

1. An identifying statement of the spouse who is the dependent spouse.

2. A copy of the tax return for the dependent spouse.

3. A copy of a tax notice for the dependent spouse that includes information such as:

4. The number of dependents.

5. A definition of the qualifying amount.

6. A definition of the qualifying period.

7. A statement that the filing date falls on or before April 15 (exception: for returns filed on April 15 to April 17)

8. When Form 1099-R will be accepted by the IRS.

9. When a financial statement will be required.

10. When the dependent spouse will be eligible for benefits of the dependent spouse and self-employment tax credit.

11. If the dependent spouse will not be entitled to any benefits from the dependent spouse's paychecks, why?

1. Dependents who are ineligible for benefits from the paychecks of the working spouse must file a joint return to qualify for the tax credit if the dependent spouse is covered by the self- employment tax credit.

2. The dependent spouse must show a good-faith effort to get the work-related benefits.

4. When dependent spouses will be entitled to child and dependent care tax credit.

5. When filers are filing for the first time each year, the dependent spouse must submit a copy of a valid photo ID issued by the state or local government.

6. When filers are filing for the first time each year, the dependent spouse must submit a copy of a valid driver's license or social security card.

12. Where do I get Form 1040, Schedule C, or Schedule D?

A. Schedule C and Schedule D can be mailed from any mail drop at your local post office. Forms are also available on the IRS Website (). See IRM 25.24.5.3.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here